All Categories

Featured

Table of Contents

There is no payout if the policy expires before your fatality or you live beyond the plan term. You may have the ability to restore a term plan at expiration, but the costs will certainly be recalculated based on your age at the time of revival. Term life insurance coverage is generally the least costly life insurance policy available due to the fact that it uses a survivor benefit for a limited time and does not have a money value element like permanent insurance coverage.

At age 50, the premium would certainly increase to $67 a month. Term Life Insurance policy Rates thirty years old $18 $15 40 years old $28 $23 half a century old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and females in outstanding health. On the other hand, here's a consider prices for a $100,000 entire life policy (which is a type of irreversible plan, meaning it lasts your life time and consists of cash money value).

What Is Spouse Term Life Insurance

The decreased danger is one element that permits insurance companies to charge reduced premiums. Rates of interest, the financials of the insurer, and state guidelines can also influence costs. In general, companies typically supply far better rates at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000. When you consider the quantity of protection you can obtain for your costs bucks, term life insurance coverage often tends to be the least pricey life insurance policy.

Thirty-year-old George desires to shield his household in the not likely event of his passing. He buys a 10-year, $500,000 term life insurance policy with a premium of $50 monthly. If George passes away within the 10-year term, the plan will certainly pay George's recipient $500,000. If he passes away after the plan has run out, his beneficiary will certainly receive no advantage.

If George is detected with an incurable disease throughout the very first policy term, he most likely will not be eligible to restore the plan when it runs out. Some plans supply ensured re-insurability (without evidence of insurability), yet such features come with a greater cost. There are a number of sorts of term life insurance.

Many term life insurance coverage has a degree premium, and it's the kind we have actually been referring to in most of this post.

Term Life Insurance Vs Accidental Death

Term life insurance coverage is eye-catching to youths with children. Parents can get significant protection for a reduced price, and if the insured passes away while the plan holds, the household can depend on the fatality benefit to change lost income. These plans are likewise well-suited for people with expanding families.

The best option for you will certainly depend upon your requirements. Here are some things to think about. Term life plans are perfect for people who desire substantial coverage at an affordable. People that have entire life insurance policy pay extra in premiums for less insurance coverage but have the security of understanding they are shielded for life.

The conversion rider should allow you to transform to any kind of long-term policy the insurance company offers without limitations - aaa direct term life insurance reviews. The primary attributes of the cyclist are keeping the initial wellness ranking of the term policy upon conversion (even if you later on have health concerns or come to be uninsurable) and choosing when and just how much of the insurance coverage to transform

Of course, overall costs will enhance substantially because entire life insurance coverage is much more expensive than term life insurance policy. The advantage is the ensured authorization without a medical test. Medical conditions that establish throughout the term life duration can not create costs to be enhanced. Nonetheless, the business might require limited or complete underwriting if you want to add extra bikers to the brand-new policy, such as a long-term care cyclist.

Entire life insurance policy comes with substantially higher regular monthly premiums. It is suggested to supply coverage for as lengthy as you live.

10 Year Level Term Life Insurance

Insurance policy firms set an optimum age limitation for term life insurance coverage plans. The costs additionally rises with age, so an individual aged 60 or 70 will certainly pay considerably more than somebody years younger.

Term life is somewhat similar to vehicle insurance coverage. It's statistically not likely that you'll need it, and the costs are cash away if you do not. If the worst happens, your family members will obtain the advantages.

This plan style is for the client that needs life insurance coverage however would love to have the capacity to pick how their cash money value is invested. Variable policies are financed by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Coverage Company, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor information, browse through Long-term life insurance coverage establishes cash money worth that can be obtained. Plan lendings build up passion and overdue policy lendings and interest will certainly decrease the fatality advantage and cash value of the policy. The amount of money value readily available will normally rely on the sort of long-term plan acquired, the amount of insurance coverage purchased, the length of time the policy has actually been in pressure and any kind of outstanding policy finances.

Term Life Insurance For Police Officers

A complete declaration of coverage is found just in the plan. Insurance coverage policies and/or associated motorcyclists and features might not be offered in all states, and plan terms and conditions may differ by state.

The major distinctions between the various kinds of term life policies on the marketplace pertain to the size of the term and the insurance coverage amount they offer.Level term life insurance comes with both degree costs and a degree death benefit, which implies they stay the very same throughout the duration of the policy.

, likewise recognized as an incremental term life insurance plan, is a policy that comes with a death benefit that enhances over time. Usual life insurance term sizes Term life insurance policy is budget-friendly.

Despite the fact that 50 %of non-life insurance coverage owners mention cost as a reason they do not have coverage, term life is among the least expensive sort of life insurance policy. You can usually obtain the insurance coverage you require at a manageable rate. Term life is simple to manage and comprehend. It offers coverage when you most need it. Term life uses economic defense

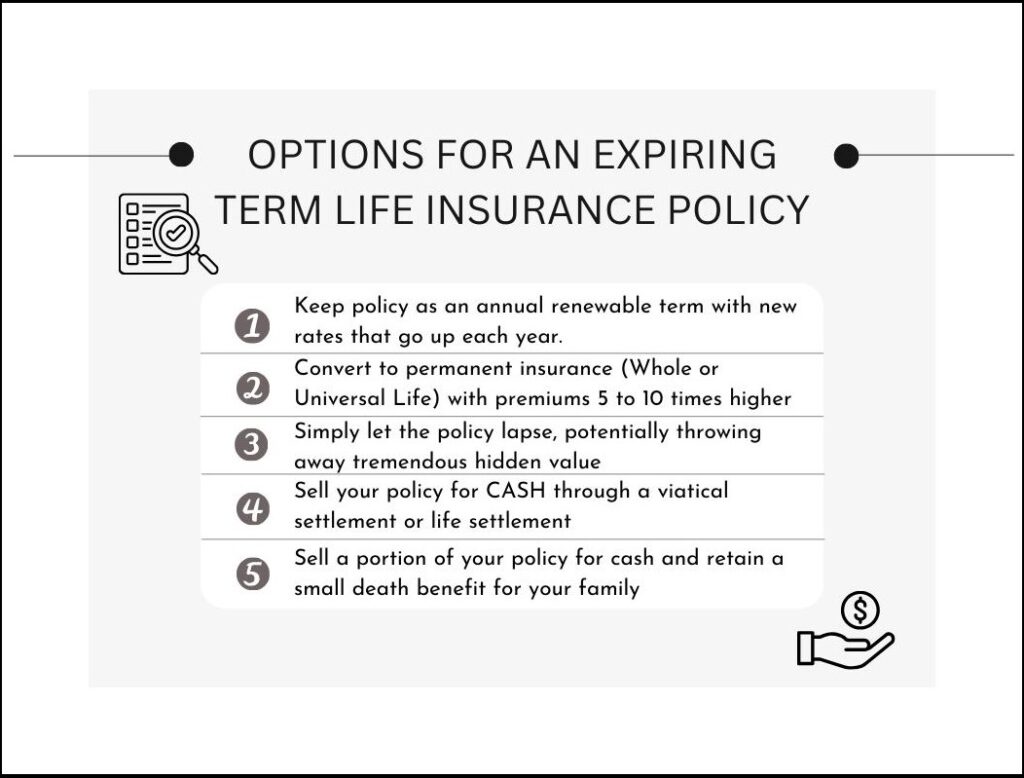

during the duration of your life when you have significant economic commitments to meet, like paying a home loan or moneying your youngsters's education and learning. Term life insurance has an expiration day. At the end of the term, you'll need to purchase a brand-new policy, restore it at a greater premium, or transform it into long-term life insurance if you still want protection. Rates might vary by insurance firm, term, insurance coverage amount, health course, and state. Not all policies are available in all states. Price image valid as of 10/01/2024. What variables impact the expense of term life insurance policy? Your prices are identified by your age, gender, and health and wellness, along with the coverage quantity and term length you pick. Term life is a good fit if you're looking for a cost effective life insurance policy policy that only lasts for a collection amount of time. If you require permanent protection or are thinking about life insurance as a financial investment choice, whole life may be a better choice for you. The major differences between term life and entire life are: The length of your insurance coverage: Term life lasts for a set period of time and after that runs out. Ordinary regular monthly entire life insurance policy price is calculated for non-smokers in a Preferred health and wellness classification, getting an entire life insurance policy plan compensated at age 100 provided by Policygenius from MassMutual. Prices may vary by insurance provider, term, coverage quantity, health class, and state. Not all plans are readily available in all states. Short-term life insurance policy's momentary policy term can be a good option for a few scenarios: You're awaiting approval on a long-term plan. Your policy has a waitingduration. You're in between jobs. You intend to cover short-term obligations, such as a lending. You're improving your wellness or way of living(such as stopping smoking cigarettes)before getting a traditional life insurance policy policy. Aflac offers various long-lasting life insurance coverage policies, including whole life insurance policy, last expense insurance coverage, and term life insurance policy. Beginning chatting with an agent today to find out more about Aflac's life insurance policy products and discover the right option for you. One of the most prominent type is currently 20-year term. A lot of companies will certainly not sell term insurance policy to an applicant for a term that finishes previous his/her 80th birthday celebration . If a plan is"eco-friendly," that suggests it continues in force for an additional term or terms, approximately a specified age, also if the health and wellness of the insured (or various other elements )would certainly create him or her to be declined if he or she applied for a brand-new life insurance policy policy. So, costs for 5-year eco-friendly term can be level for 5 years, after that to a new price showing the new age of the insured, and so on every five years. Some longer term plans will guarantee that the costs will certainly notenhance during the term; others do not make that guarantee, allowing the insurance provider to raise the rate throughout the policy's term. This means that the plan's owner deserves to alter it right into a long-term sort of life insurance policy without extra proof of insurability. In many kinds of term insurance coverage, including house owners and automobile insurance coverage, if you haven't had a case under the plan by the time it expires, you obtain no refund of the costs. Some term life insurance policy customers have been unhappy at this outcome, so some insurance providers have produced term life with a"return of premium" attribute. The premiums for the insurance coverage with this attribute are usually dramatically greater than for policies without it, and they normally call for that you maintain the plan effective to its term otherwise you waive the return of costs advantage. Weding with young kids-Life insurance policy can assist your partner preserve your home, existing lifestyle and offer your youngsters's support. Solitary parent and single breadwinner- Life insurance policy can aid a caretaker cover childcare expenses and other living costs and fulfill plans for your child's future education and learning. Weding without kids- Life insurance can provide the cash to meet economic commitments and aid your partner keep the possessions and way of life you've both functioned tough to achieve. Yet you may have the alternative to convert your term plan to long-term life insurance policy. Insurance coverage that safeguards a person for a defined duration and pays a fatality benefit if the covered person dies during that time. Like all life insurance policy plans, term protection assists maintain a family members's monetary wellness in case an enjoyed one passes away. What makes term insurance policy various, is that the guaranteed person is covered for a certainamount of time. Because these policies do not supply long-lasting coverage, they can be reasonably budget-friendly when compared to a long-term life insurance coverage plan with the very same quantity of coverage. While the majority of term plans supply dependable, temporary protection, some are a lot more adaptable than others. At New York Life, our term plans use a distinct combination of functions that can assist if you come to be handicapped,2 become terminally ill,3 or simply wish to transform to an irreversible life plan.4 Since term life insurance policy offers momentary protection, lots of people like to match the size of their policy with a vital landmark, such as paying off a mortgage or seeing children via college. Level premium term could be much more efficient if you desire the costs you pay to stay the very same for 10, 15, or twenty years. Once that period ends, the amount you spend for coverage will enhance annually. While both kinds of coverage can be reliable, the choice to choose one over the other boils down to your certain demands. Considering that nobody understands what the future has in shop, it is essential to make certain your protection is reputable sufficient to meet today's needsand versatileadequate to aid you plan for tomorrow's. Here are some key variables to maintain in mind: When it pertains to something this vital, you'll intend to ensure the firm you utilize is monetarily sound and has a proven history of keeping its promises. Ask if there are functions and advantages you can use in instance your requirements change later on.

Latest Posts

Level Premium Term Life Insurance Policies

Guaranteed Issue Term Life Insurance

What Is Level Term V Life Insurance